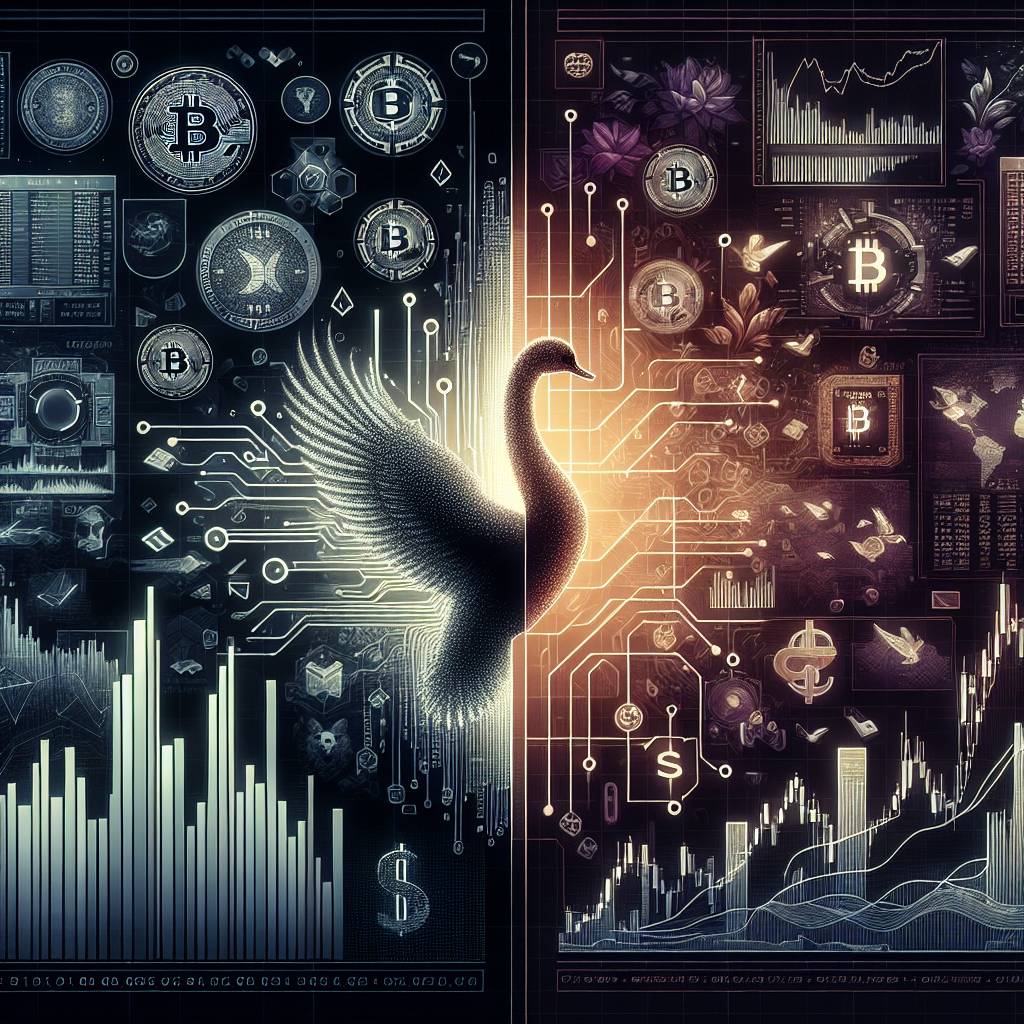

How can investors prepare for a black swan moment in the cryptocurrency industry?

What steps can investors take to protect themselves in the event of a major unexpected event in the cryptocurrency industry?

3 answers

- Investors should diversify their cryptocurrency holdings to minimize the impact of a black swan event. By spreading their investments across different cryptocurrencies, investors can reduce the risk of a single event causing significant losses. Additionally, investors should stay informed about the latest news and developments in the cryptocurrency industry to identify potential risks and take appropriate actions. Another strategy is to set stop-loss orders to automatically sell cryptocurrencies if their value drops below a certain threshold. This can help limit potential losses in the event of a sudden market crash or other unexpected events. It's also important for investors to have a clear exit strategy and not to invest more than they can afford to lose. In addition, investors can consider hedging their cryptocurrency investments by holding traditional assets such as stocks or bonds. This can help offset potential losses in the cryptocurrency market during a black swan event. However, it's important to note that hedging strategies may also have their own risks and should be carefully evaluated. Overall, being proactive, diversifying investments, staying informed, and having a clear exit strategy are key steps investors can take to prepare for a black swan moment in the cryptocurrency industry.

Dec 27, 2021 · 3 years ago

Dec 27, 2021 · 3 years ago - When it comes to preparing for a black swan moment in the cryptocurrency industry, investors need to be cautious and proactive. One important step is to conduct thorough research and due diligence before investing in any cryptocurrency. This includes understanding the technology behind the cryptocurrency, evaluating its potential risks and rewards, and assessing the credibility and track record of the team behind the project. Investors should also consider the long-term potential of the cryptocurrency they are investing in. While short-term price fluctuations are common in the cryptocurrency market, it's important to focus on the underlying technology and the problem the cryptocurrency is trying to solve. Furthermore, investors should be prepared for volatility in the cryptocurrency market. Black swan events can cause significant price swings, and it's important to have a clear risk management strategy in place. This may include setting stop-loss orders, diversifying investments, and not investing more than one can afford to lose. Lastly, investors should stay informed about the latest news and developments in the cryptocurrency industry. This can help them identify potential risks and take appropriate actions to protect their investments. In conclusion, by conducting thorough research, focusing on long-term potential, managing risk, and staying informed, investors can better prepare for a black swan moment in the cryptocurrency industry.

Dec 27, 2021 · 3 years ago

Dec 27, 2021 · 3 years ago - In the face of a black swan moment in the cryptocurrency industry, investors need to be prepared for the unexpected. One way to do this is by diversifying their cryptocurrency holdings. Instead of putting all their eggs in one basket, investors can spread their investments across multiple cryptocurrencies. This can help mitigate the impact of a single event on their overall portfolio. Another important step is to set realistic expectations and not get caught up in the hype. The cryptocurrency market is known for its volatility, and it's important for investors to understand that there will be ups and downs. By setting realistic goals and not being swayed by short-term price movements, investors can better weather a black swan event. Additionally, investors should stay informed about the latest news and developments in the cryptocurrency industry. This includes keeping up with regulatory changes, technological advancements, and market trends. By staying informed, investors can make more informed decisions and be better prepared for unexpected events. Lastly, it's important for investors to have a long-term perspective. While black swan events can cause short-term disruptions, the underlying technology and potential of cryptocurrencies remain strong. By focusing on the long-term potential and not getting caught up in short-term fluctuations, investors can navigate through a black swan moment in the cryptocurrency industry.

Dec 27, 2021 · 3 years ago

Dec 27, 2021 · 3 years ago

Related Tags

Hot Questions

- 89

How can I minimize my tax liability when dealing with cryptocurrencies?

- 79

What is the future of blockchain technology?

- 78

How can I buy Bitcoin with a credit card?

- 59

How does cryptocurrency affect my tax return?

- 53

Are there any special tax rules for crypto investors?

- 36

What are the tax implications of using cryptocurrency?

- 28

What are the best practices for reporting cryptocurrency on my taxes?

- 14

What are the best digital currencies to invest in right now?