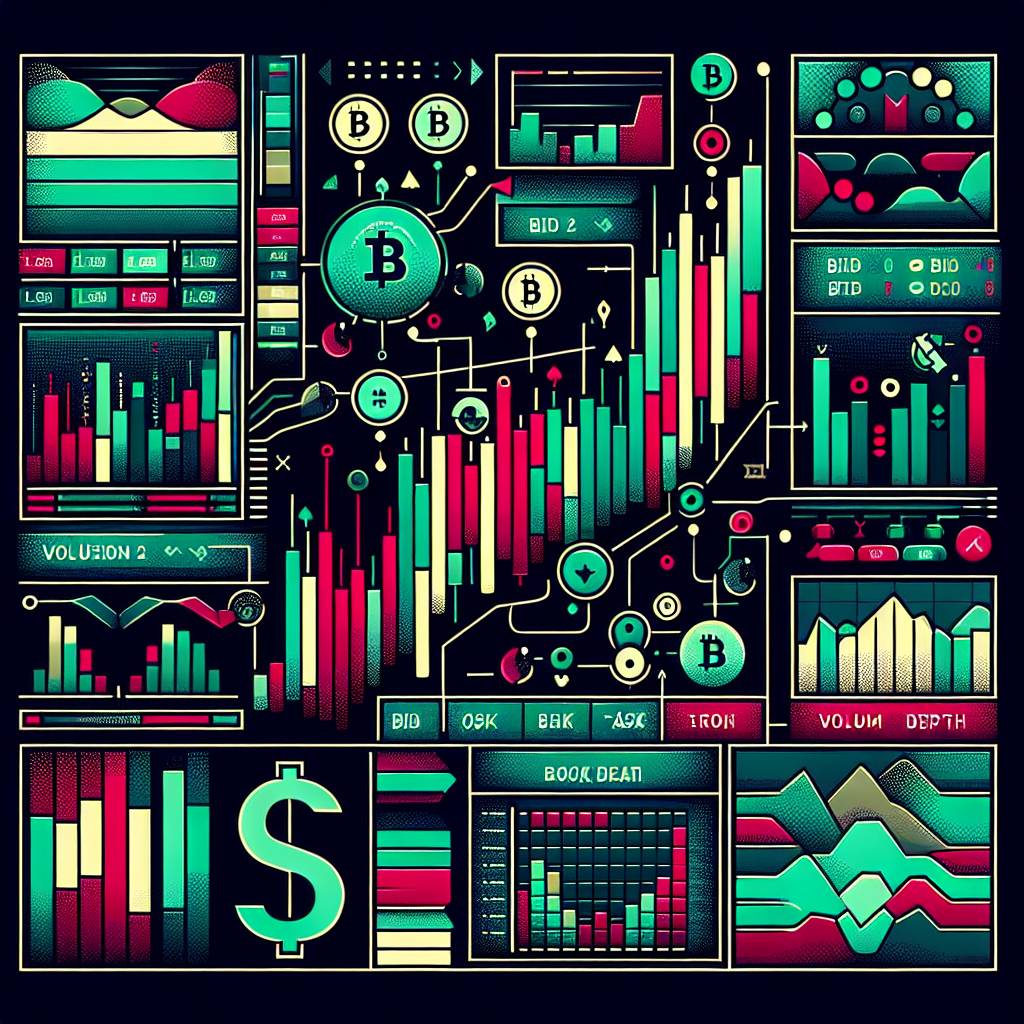

How can understanding level 2 market data help traders make informed decisions in the cryptocurrency market?

What is level 2 market data and how does it contribute to making informed decisions in the cryptocurrency market?

5 answers

- Level 2 market data refers to real-time order book information that shows the current buy and sell orders for a particular cryptocurrency. By understanding level 2 market data, traders can gain insights into the supply and demand dynamics of the market. This information can help them make more informed decisions by identifying potential support and resistance levels, detecting market manipulation, and spotting liquidity imbalances. Traders can use level 2 market data to gauge the strength of the market and make better entry and exit decisions based on the order book depth.

Dec 27, 2021 · 3 years ago

Dec 27, 2021 · 3 years ago - Understanding level 2 market data is crucial for traders in the cryptocurrency market as it provides a deeper view of the market beyond just the current price. By analyzing the order book depth and the distribution of buy and sell orders, traders can identify areas of strong buying or selling pressure. This can help them anticipate potential price movements and adjust their trading strategies accordingly. Level 2 market data also allows traders to spot large orders that may impact the market and react accordingly. Overall, level 2 market data empowers traders with valuable insights to make more informed and profitable trading decisions.

Dec 27, 2021 · 3 years ago

Dec 27, 2021 · 3 years ago - Level 2 market data is a powerful tool for traders in the cryptocurrency market. It provides a detailed view of the current supply and demand dynamics, allowing traders to see the actual orders being placed by other market participants. This information can help traders identify areas of support and resistance, understand the market sentiment, and make more informed trading decisions. For example, if there is a large buy order at a certain price level, it indicates strong demand and may suggest a potential price increase. On the other hand, a large sell order may indicate selling pressure and a potential price decrease. By understanding level 2 market data, traders can gain a competitive edge and improve their trading performance.

Dec 27, 2021 · 3 years ago

Dec 27, 2021 · 3 years ago - Understanding level 2 market data is essential for traders who want to make informed decisions in the cryptocurrency market. Level 2 market data provides valuable insights into the supply and demand dynamics of a particular cryptocurrency, allowing traders to gauge the market sentiment and identify potential price levels of interest. By analyzing the order book depth, traders can identify areas of support and resistance, which can help them determine optimal entry and exit points for their trades. Additionally, level 2 market data can help traders detect market manipulation and spot liquidity imbalances, which can further enhance their decision-making process. Overall, level 2 market data is a valuable tool that can help traders make more informed and profitable trading decisions.

Dec 27, 2021 · 3 years ago

Dec 27, 2021 · 3 years ago - In the cryptocurrency market, understanding level 2 market data can give traders a competitive edge. Level 2 market data provides a detailed view of the current buy and sell orders, allowing traders to see the supply and demand dynamics in real-time. By analyzing the order book depth, traders can identify areas of strong support and resistance, which can help them make more accurate predictions about potential price movements. Additionally, level 2 market data can help traders spot liquidity imbalances and detect market manipulation, which can be crucial in making informed decisions. Overall, level 2 market data is a valuable resource that can help traders navigate the cryptocurrency market with confidence.

Dec 27, 2021 · 3 years ago

Dec 27, 2021 · 3 years ago

Related Tags

Hot Questions

- 90

Are there any special tax rules for crypto investors?

- 83

What is the future of blockchain technology?

- 53

What are the tax implications of using cryptocurrency?

- 47

How can I minimize my tax liability when dealing with cryptocurrencies?

- 38

What are the advantages of using cryptocurrency for online transactions?

- 21

What are the best digital currencies to invest in right now?

- 16

How can I protect my digital assets from hackers?

- 13

How does cryptocurrency affect my tax return?