What are the best ways to automate investing in cryptocurrencies?

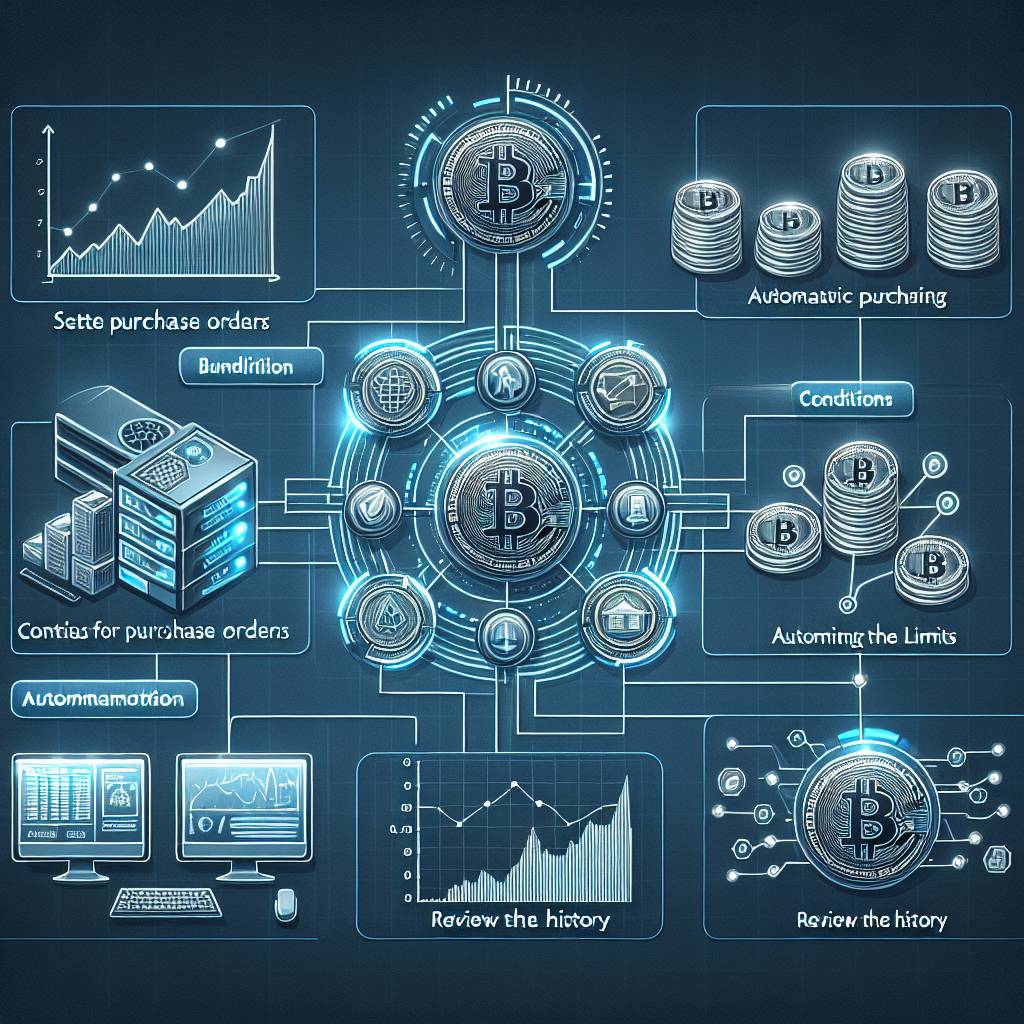

I'm interested in automating my cryptocurrency investments, but I'm not sure where to start. What are some of the best strategies or methods for automating investments in cryptocurrencies? I want to make sure I'm taking advantage of the latest technology and tools to optimize my investment portfolio.

3 answers

- One of the best ways to automate investing in cryptocurrencies is to use a trading bot. These bots are designed to execute trades on your behalf based on pre-set parameters and algorithms. They can help you take advantage of market opportunities and make trades even when you're not actively monitoring the market. However, it's important to choose a reputable and secure trading bot, as there are many scams in the market. Make sure to do your research and read reviews before selecting a bot. Another option is to use a robo-advisor specifically designed for cryptocurrencies. These platforms use algorithms to create and manage a diversified portfolio of cryptocurrencies based on your risk tolerance and investment goals. They can automatically rebalance your portfolio and make adjustments as market conditions change. Some popular robo-advisors in the cryptocurrency space include Coinbase and Bitwise. Overall, automating your cryptocurrency investments can help you save time and potentially optimize your returns. However, it's important to stay informed about the market and regularly review your investment strategy to ensure it aligns with your goals and risk tolerance.

Dec 25, 2021 · 3 years ago

Dec 25, 2021 · 3 years ago - Automating your cryptocurrency investments can be a great way to take advantage of market opportunities and optimize your portfolio. One strategy is to set up recurring purchases of cryptocurrencies. This can be done through various platforms and exchanges, such as Coinbase or Binance. By setting up recurring purchases, you can automatically buy a certain amount of cryptocurrencies at regular intervals, regardless of the market price. This strategy is known as dollar-cost averaging and can help reduce the impact of short-term market volatility. Another option is to use a cryptocurrency index fund. These funds are designed to track the performance of a specific index or market segment. By investing in an index fund, you can gain exposure to a diversified portfolio of cryptocurrencies without the need to actively manage individual coins. Some popular cryptocurrency index funds include Grayscale's Bitcoin Trust (GBTC) and Bitwise's 10 Crypto Index Fund. Regardless of the automation method you choose, it's important to regularly review your investment strategy and make adjustments as needed. The cryptocurrency market is highly volatile, and staying informed is key to successful investing.

Dec 25, 2021 · 3 years ago

Dec 25, 2021 · 3 years ago - BYDFi is a popular cryptocurrency exchange that offers a range of automated investment options. With BYDFi, you can set up automatic recurring purchases of cryptocurrencies, similar to dollar-cost averaging. This allows you to regularly invest in cryptocurrencies without the need for manual intervention. Additionally, BYDFi offers a feature called 'Smart Portfolio' which automatically rebalances your portfolio based on market conditions. This can help optimize your returns and reduce risk. In addition to BYDFi, there are other cryptocurrency exchanges and platforms that offer automated investment options. Some popular ones include Coinbase, Binance, and eToro. These platforms allow you to set up recurring purchases, use trading bots, or invest in index funds. It's important to research and compare different platforms to find the one that best suits your investment goals and preferences.

Dec 25, 2021 · 3 years ago

Dec 25, 2021 · 3 years ago

Related Tags

Hot Questions

- 95

What are the tax implications of using cryptocurrency?

- 89

Are there any special tax rules for crypto investors?

- 36

What is the future of blockchain technology?

- 29

How can I buy Bitcoin with a credit card?

- 21

What are the best practices for reporting cryptocurrency on my taxes?

- 19

How can I protect my digital assets from hackers?

- 11

How does cryptocurrency affect my tax return?

- 9

What are the best digital currencies to invest in right now?