What are the differences between a self-custodial wallet and a centralized wallet?

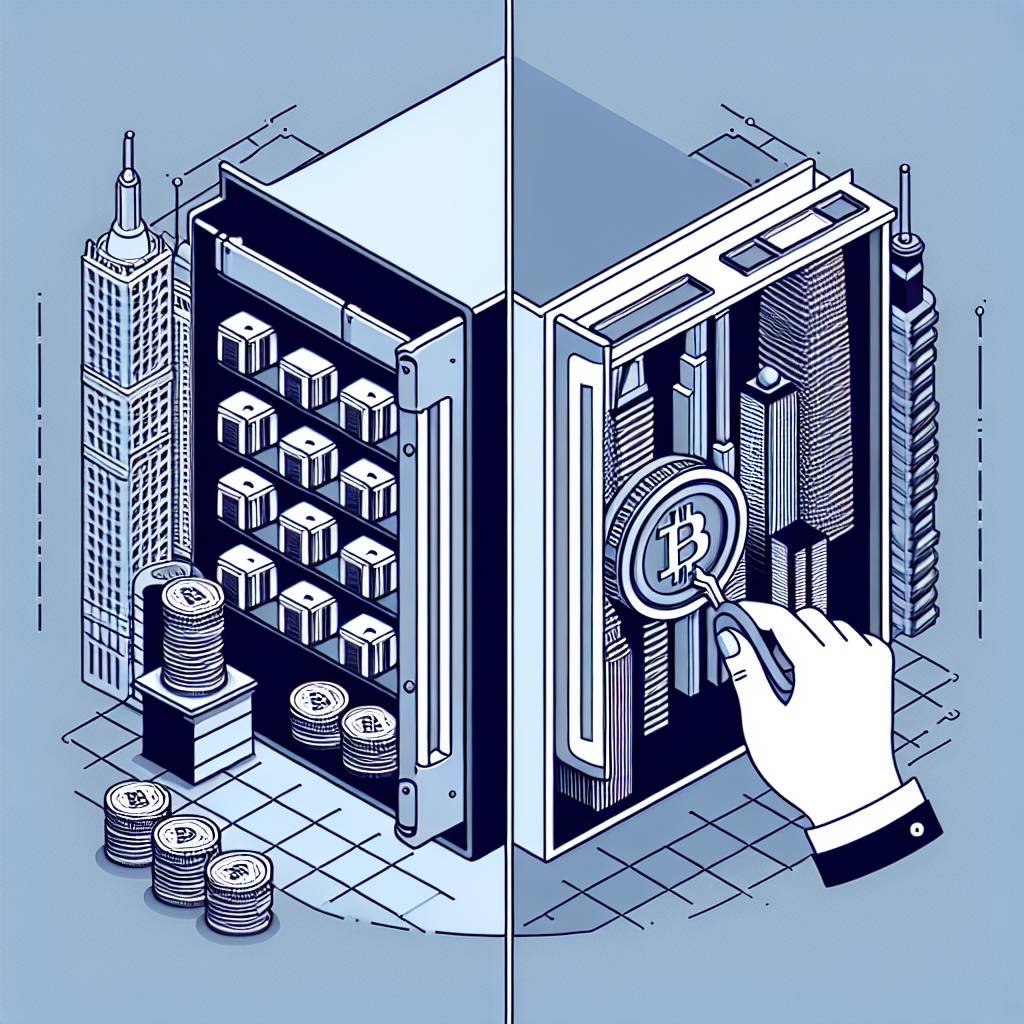

Can you explain the key differences between a self-custodial wallet and a centralized wallet in the context of cryptocurrencies? How do they differ in terms of security, control, and privacy?

3 answers

- A self-custodial wallet, also known as a non-custodial wallet, gives you complete control over your cryptocurrency funds. With this type of wallet, you are responsible for managing your private keys, which are used to access and transfer your funds. This means that you have full ownership and control over your assets, but it also means that you bear the responsibility for keeping your private keys secure. On the other hand, a centralized wallet is managed by a third-party service, such as a cryptocurrency exchange. While this type of wallet may offer convenience and additional features, it requires you to trust the service provider with the custody of your funds. This means that you do not have direct control over your assets and are dependent on the service provider's security measures and policies.

Dec 25, 2021 · 3 years ago

Dec 25, 2021 · 3 years ago - When it comes to security, self-custodial wallets are generally considered to be more secure than centralized wallets. Since you have control over your private keys, the risk of your funds being compromised due to a security breach or hacking attack is significantly reduced. However, this also means that you need to take extra precautions to protect your private keys from loss or theft. Centralized wallets, on the other hand, may offer additional security measures such as two-factor authentication and cold storage, but they are still more vulnerable to hacking attacks and insider threats compared to self-custodial wallets.

Dec 25, 2021 · 3 years ago

Dec 25, 2021 · 3 years ago - At BYDFi, we believe in the importance of self-custodial wallets for the security and privacy of our users' funds. By using a self-custodial wallet, you can ensure that you have full control over your assets and reduce the risk of unauthorized access or loss. We recommend using hardware wallets or software wallets that allow you to control your private keys. Remember, the security of your cryptocurrency funds should always be your top priority.

Dec 25, 2021 · 3 years ago

Dec 25, 2021 · 3 years ago

Related Tags

Hot Questions

- 91

What is the future of blockchain technology?

- 86

What are the best digital currencies to invest in right now?

- 80

How can I minimize my tax liability when dealing with cryptocurrencies?

- 64

What are the tax implications of using cryptocurrency?

- 64

What are the advantages of using cryptocurrency for online transactions?

- 37

How does cryptocurrency affect my tax return?

- 32

Are there any special tax rules for crypto investors?

- 24

What are the best practices for reporting cryptocurrency on my taxes?