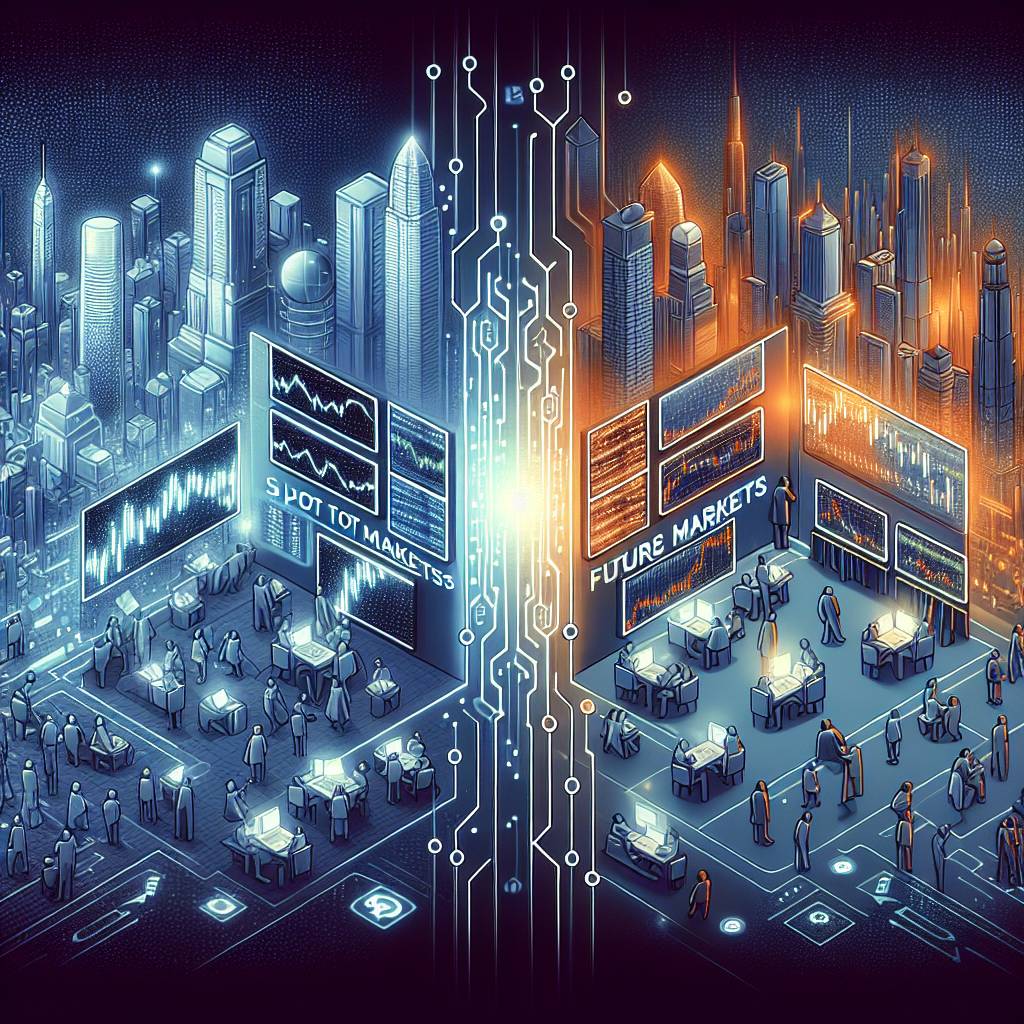

What are the differences between spot trading and future trading in the crypto market?

Can you explain the key distinctions between spot trading and future trading in the cryptocurrency market? How do these two types of trading differ in terms of execution, settlement, and risk? What are the advantages and disadvantages of each?

3 answers

- Spot trading involves the immediate purchase or sale of cryptocurrencies at the current market price. It is settled instantly and requires the actual delivery of the assets. On the other hand, future trading allows traders to buy or sell cryptocurrencies at a predetermined price for future delivery. It involves contracts and is settled at a later date. Spot trading offers more liquidity and flexibility, while future trading allows traders to hedge against price fluctuations. Both have their own risks and rewards, so it's important to understand your trading goals and risk tolerance before choosing one over the other.

Dec 26, 2021 · 3 years ago

Dec 26, 2021 · 3 years ago - Spot trading is like buying or selling cryptocurrencies on the spot, just like buying groceries at a supermarket. You pay the current price and get the assets immediately. Future trading, on the other hand, is like placing a bet on the future price of cryptocurrencies. You agree to buy or sell at a specific price on a specific date. It's more like making a reservation at a restaurant. Spot trading is more straightforward and suitable for short-term traders, while future trading requires more knowledge and is often used by institutional investors and experienced traders to manage risk and speculate on price movements.

Dec 26, 2021 · 3 years ago

Dec 26, 2021 · 3 years ago - Spot trading and future trading are two different approaches to trading cryptocurrencies. Spot trading is the most common form of trading, where you buy or sell cryptocurrencies at the current market price. It's simple and immediate. Future trading, on the other hand, involves entering into a contract to buy or sell cryptocurrencies at a predetermined price and date in the future. It allows traders to speculate on the price movement without actually owning the underlying assets. Future trading offers leverage and the ability to profit from both rising and falling markets, but it also carries higher risks. It's important to carefully consider your trading strategy and risk tolerance before engaging in either spot trading or future trading.

Dec 26, 2021 · 3 years ago

Dec 26, 2021 · 3 years ago

Related Tags

Hot Questions

- 86

How does cryptocurrency affect my tax return?

- 66

What are the best practices for reporting cryptocurrency on my taxes?

- 60

Are there any special tax rules for crypto investors?

- 55

What are the best digital currencies to invest in right now?

- 49

How can I minimize my tax liability when dealing with cryptocurrencies?

- 49

How can I protect my digital assets from hackers?

- 45

What is the future of blockchain technology?

- 15

What are the tax implications of using cryptocurrency?