What are the differences between stock fvc and cryptocurrencies in terms of market volatility?

Can you explain the key differences between stock fvc and cryptocurrencies in terms of market volatility? How do these two types of assets differ in terms of price fluctuations and risk levels?

5 answers

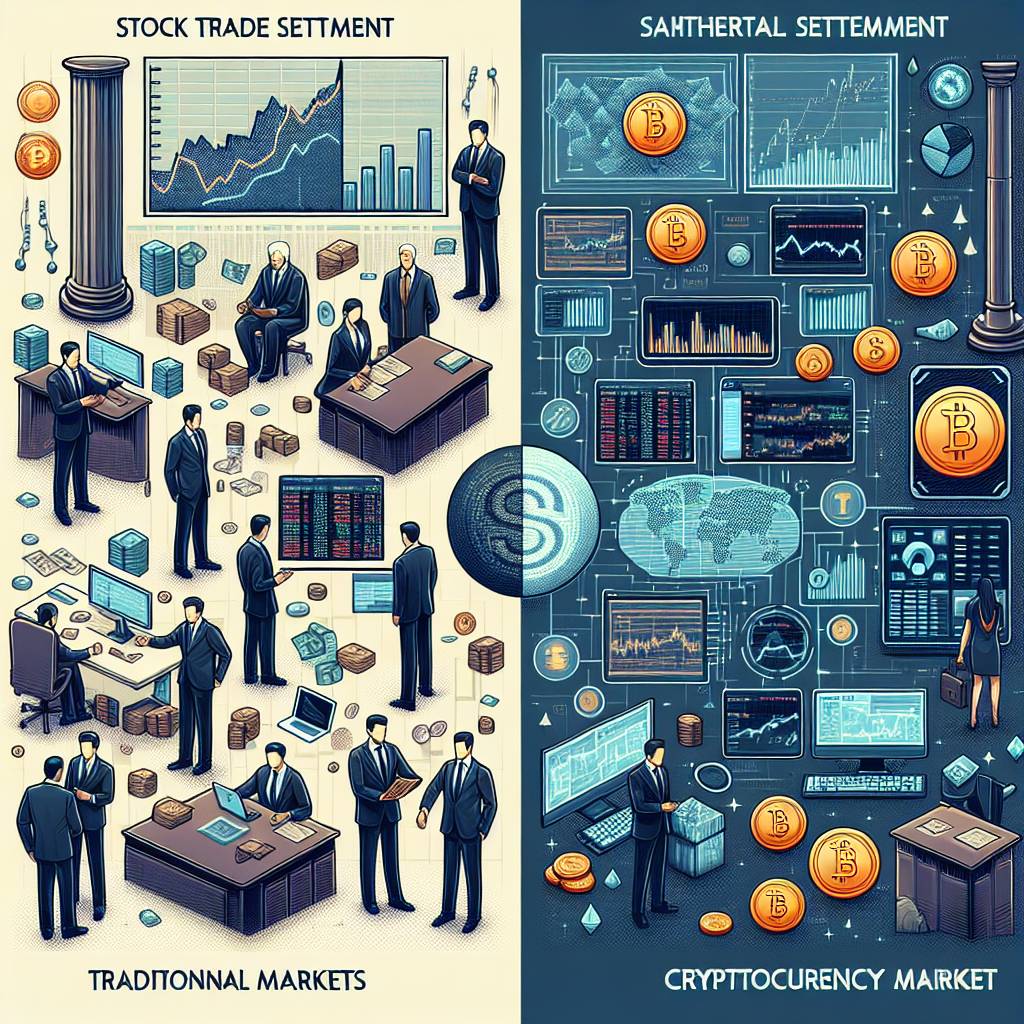

- Stock fvc and cryptocurrencies differ significantly in terms of market volatility. Stock fvc refers to shares of ownership in a company, which are traded on traditional stock exchanges. The price of stock fvc can be influenced by various factors such as company performance, economic conditions, and market sentiment. Cryptocurrencies, on the other hand, are digital assets that are decentralized and operate on blockchain technology. The price of cryptocurrencies is highly volatile and can be influenced by factors such as market demand, regulatory changes, and technological advancements. Unlike stock fvc, cryptocurrencies are not tied to the performance of a specific company, making them more susceptible to price fluctuations.

Dec 27, 2021 · 3 years ago

Dec 27, 2021 · 3 years ago - When it comes to market volatility, stock fvc and cryptocurrencies are like night and day. Stock fvc, being traded on traditional exchanges, tends to have relatively stable price movements. While there can be fluctuations, they are usually influenced by company-specific news or broader economic trends. On the other hand, cryptocurrencies are known for their wild price swings. The crypto market is highly speculative and driven by factors such as investor sentiment, media coverage, and regulatory developments. This volatility can present both opportunities and risks for investors.

Dec 27, 2021 · 3 years ago

Dec 27, 2021 · 3 years ago - As an expert in the cryptocurrency industry, I can tell you that market volatility is a defining characteristic of cryptocurrencies. Unlike stock fvc, which is subject to regulations and operates within established financial systems, cryptocurrencies are decentralized and operate on a global scale. This lack of regulation and oversight contributes to their high volatility. Additionally, the relatively small market size of cryptocurrencies compared to traditional stock markets can amplify price movements. It's important for investors to understand and manage the risks associated with this volatility.

Dec 27, 2021 · 3 years ago

Dec 27, 2021 · 3 years ago - Stock fvc and cryptocurrencies have distinct differences in terms of market volatility. Stock fvc, being part of established financial markets, tends to have lower volatility compared to cryptocurrencies. This is due to the fact that stock fvc prices are influenced by a wide range of factors, including company performance, economic indicators, and market sentiment. Cryptocurrencies, on the other hand, are highly volatile due to their decentralized nature and speculative nature. Factors such as market demand, regulatory changes, and technological advancements can cause significant price fluctuations in the crypto market. It's crucial for investors to carefully assess their risk tolerance when considering investing in either asset class.

Dec 27, 2021 · 3 years ago

Dec 27, 2021 · 3 years ago - BYDFi, a leading digital asset exchange, provides a platform for trading cryptocurrencies with a focus on security and user experience. When comparing stock fvc and cryptocurrencies in terms of market volatility, it's important to note that cryptocurrencies tend to exhibit higher levels of volatility. This is primarily due to the fact that cryptocurrencies are relatively new and operate in a less regulated environment compared to traditional stock markets. However, this volatility can also present opportunities for traders to profit from price movements. BYDFi offers a wide range of cryptocurrencies for trading, allowing users to take advantage of market volatility and potentially generate returns.

Dec 27, 2021 · 3 years ago

Dec 27, 2021 · 3 years ago

Related Tags

Hot Questions

- 81

What is the future of blockchain technology?

- 67

What are the best practices for reporting cryptocurrency on my taxes?

- 64

How can I buy Bitcoin with a credit card?

- 61

Are there any special tax rules for crypto investors?

- 59

How can I minimize my tax liability when dealing with cryptocurrencies?

- 55

What are the best digital currencies to invest in right now?

- 35

What are the advantages of using cryptocurrency for online transactions?

- 27

How can I protect my digital assets from hackers?