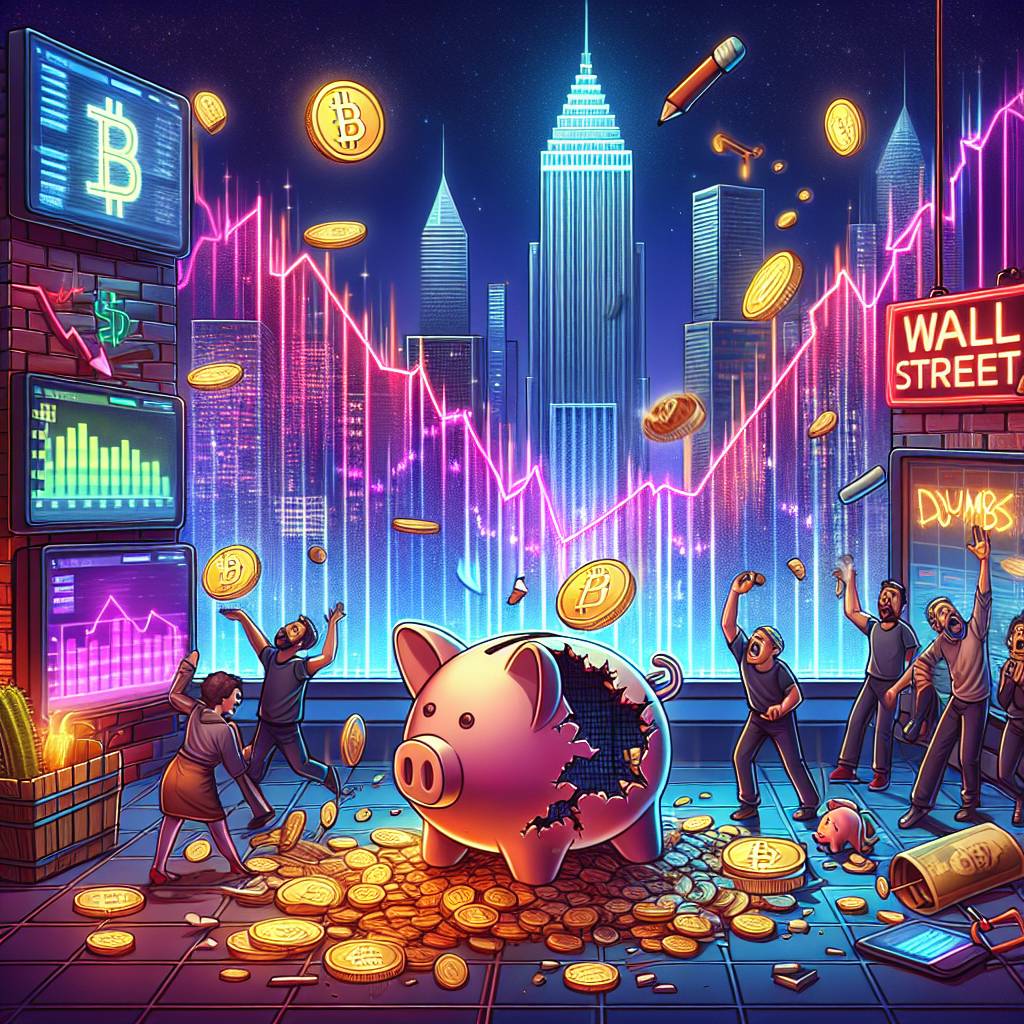

What are the dumbest ways to lose money in the cryptocurrency market?

In the volatile world of cryptocurrency, there are numerous ways to lose money. What are some of the most foolish and avoidable mistakes that can lead to financial losses in the cryptocurrency market?

3 answers

- One of the dumbest ways to lose money in the cryptocurrency market is by falling for scams and fraudulent schemes. These can come in the form of fake ICOs, Ponzi schemes, or phishing attacks. It's important to always do thorough research and due diligence before investing in any project or giving away personal information. Another common mistake is investing in projects without understanding the technology or the team behind it. Many people get caught up in the hype and invest blindly, only to realize later that the project was a scam or had no real value. Additionally, trading based on emotions and FOMO (fear of missing out) can lead to significant losses. It's important to have a clear strategy and stick to it, rather than making impulsive decisions based on market trends or rumors. Lastly, neglecting to secure your cryptocurrency holdings can also result in losses. Storing your coins on insecure exchanges or wallets, or falling victim to hacking attempts, can lead to the loss of your entire investment. It's crucial to use reputable exchanges and secure wallets to protect your assets.

Dec 26, 2021 · 3 years ago

Dec 26, 2021 · 3 years ago - Losing money in the cryptocurrency market can be as simple as not doing your own research. Many people rely on tips and advice from others without verifying the information themselves. This can lead to poor investment decisions and ultimately financial losses. Another dumb way to lose money is by investing more than you can afford to lose. Cryptocurrency markets are highly volatile, and prices can fluctuate dramatically. Investing money that you cannot afford to lose can put you in a precarious financial situation. Furthermore, not diversifying your cryptocurrency portfolio is a common mistake. Putting all your eggs in one basket can be risky, as the value of a single cryptocurrency can plummet overnight. It's important to spread your investments across different cryptocurrencies and even other asset classes. Lastly, falling for pump-and-dump schemes is a surefire way to lose money. These schemes involve artificially inflating the price of a cryptocurrency through false information or coordinated buying, only to sell at a profit and leave others with significant losses. It's important to be aware of these schemes and avoid getting caught up in the hype.

Dec 26, 2021 · 3 years ago

Dec 26, 2021 · 3 years ago - BYDFi, as a reputable cryptocurrency exchange, aims to provide a safe and secure trading environment for its users. However, one of the dumbest ways to lose money in the cryptocurrency market is by blindly trusting any exchange without conducting proper research. It's important to choose exchanges that have a good reputation, strong security measures, and transparent policies. Another mistake to avoid is falling for pump-and-dump groups or signals. These groups manipulate the market by artificially inflating the price of a cryptocurrency, only to sell at a profit and leave others with losses. It's crucial to be cautious of any group or signal that promises guaranteed profits. Additionally, investing in unknown or low-quality cryptocurrencies can lead to losses. It's important to thoroughly research the project, its team, and its potential before investing. Avoid investing in projects with red flags or no clear use case. Lastly, failing to set stop-loss orders can result in significant losses. Stop-loss orders automatically sell your cryptocurrency when it reaches a certain price, helping to limit potential losses. It's important to use this risk management tool to protect your investments.

Dec 26, 2021 · 3 years ago

Dec 26, 2021 · 3 years ago

Related Tags

Hot Questions

- 71

How does cryptocurrency affect my tax return?

- 56

What are the advantages of using cryptocurrency for online transactions?

- 48

What are the best digital currencies to invest in right now?

- 38

What are the best practices for reporting cryptocurrency on my taxes?

- 34

How can I buy Bitcoin with a credit card?

- 22

How can I protect my digital assets from hackers?

- 21

Are there any special tax rules for crypto investors?

- 19

What is the future of blockchain technology?