What are the potential risks of financial contagion in the cryptocurrency industry?

What are some of the potential risks that could lead to financial contagion in the cryptocurrency industry?

3 answers

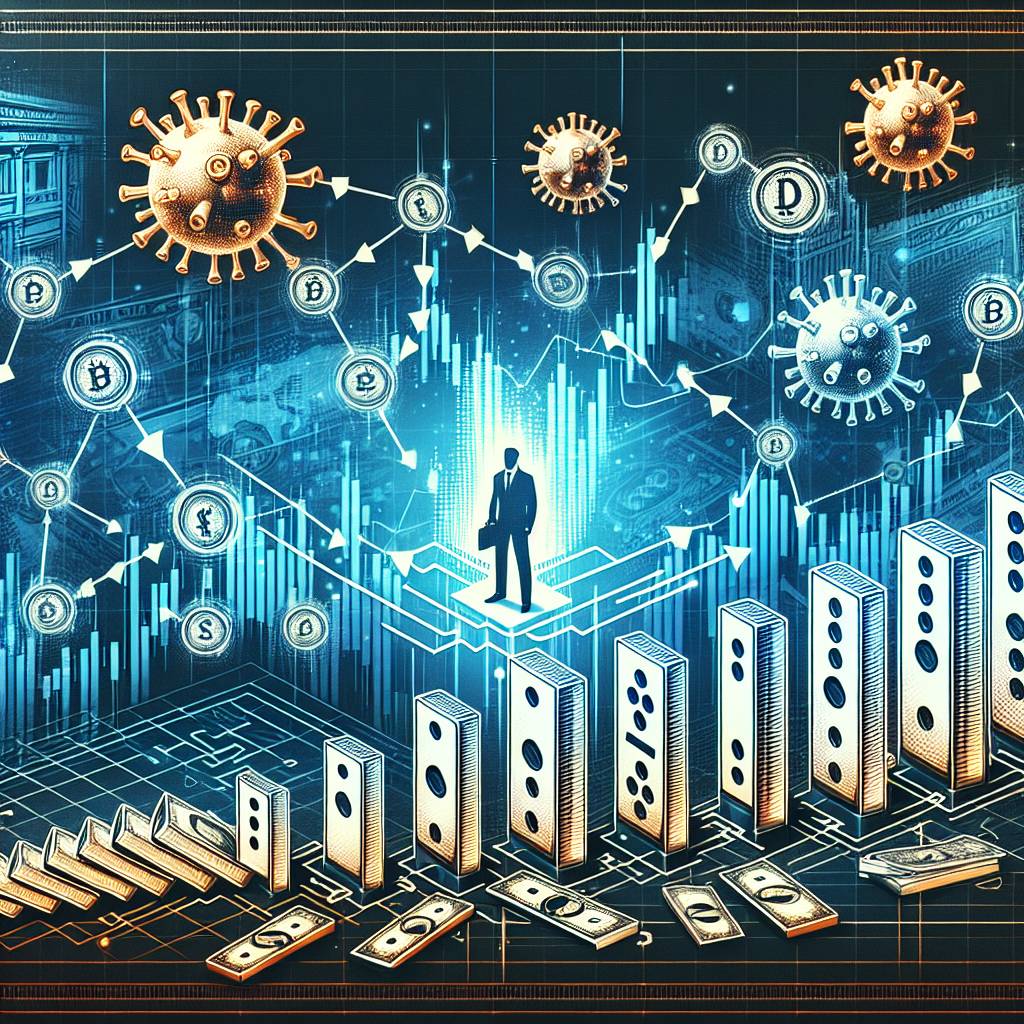

- One potential risk of financial contagion in the cryptocurrency industry is the high volatility of cryptocurrencies. The prices of cryptocurrencies can fluctuate dramatically within a short period of time, which can lead to panic selling and a domino effect on other cryptocurrencies. This can create a contagion effect where the decline in one cryptocurrency's value spreads to other cryptocurrencies, causing a market-wide crash. Another potential risk is the lack of regulation in the cryptocurrency industry. Without proper oversight and regulation, fraudulent activities such as scams and Ponzi schemes can thrive, leading to financial losses for investors. If one fraudulent cryptocurrency collapses, it can erode trust in the entire industry and trigger a contagion effect where investors lose confidence in other cryptocurrencies as well. Additionally, the interconnectedness of the cryptocurrency market can also contribute to financial contagion. Many cryptocurrencies are traded on multiple exchanges, and a significant event or failure in one exchange can have ripple effects on other exchanges. This can lead to a loss of liquidity and confidence in the market, causing a contagion effect where investors rush to withdraw their funds from other exchanges, further exacerbating the situation. Overall, the potential risks of financial contagion in the cryptocurrency industry include high volatility, lack of regulation, and interconnectedness of the market. These risks can lead to a domino effect where the decline of one cryptocurrency's value spreads to others, eroding trust and causing financial losses for investors.

Dec 26, 2021 · 3 years ago

Dec 26, 2021 · 3 years ago - Financial contagion in the cryptocurrency industry can be a serious concern due to the potential risks involved. One of the main risks is the lack of transparency in the market. Unlike traditional financial markets, the cryptocurrency industry operates with limited regulation and oversight. This lack of transparency can make it difficult for investors to assess the true value and risks associated with different cryptocurrencies, increasing the likelihood of contagion. Another risk is the susceptibility to cyber attacks. The decentralized nature of cryptocurrencies makes them vulnerable to hacking and theft. If a major exchange or wallet provider is compromised, it can lead to a loss of funds for many investors, causing panic and a potential contagion effect. Furthermore, the reliance on technology and infrastructure in the cryptocurrency industry poses a risk of systemic failures. Technical glitches, software bugs, or even power outages can disrupt trading and cause market-wide panic. If investors lose confidence in the stability and reliability of the cryptocurrency infrastructure, it can trigger a contagion effect where they start selling off their holdings in other cryptocurrencies as well. In conclusion, the potential risks of financial contagion in the cryptocurrency industry include lack of transparency, susceptibility to cyber attacks, and systemic failures. These risks can create a domino effect where the decline or failure of one cryptocurrency spreads to others, leading to financial losses and instability in the market.

Dec 26, 2021 · 3 years ago

Dec 26, 2021 · 3 years ago - BYDFi, as a leading cryptocurrency exchange, recognizes the potential risks of financial contagion in the industry. While the cryptocurrency market offers great opportunities for investors, it also comes with inherent risks that can lead to contagion. One of the risks is the lack of investor education and awareness. Many people are attracted to the cryptocurrency industry without fully understanding the risks involved. This can lead to panic selling and a contagion effect when market conditions become unfavorable. Another risk is the speculative nature of the cryptocurrency market. Many investors enter the market with the intention of making quick profits, which can contribute to excessive price volatility. When prices start to decline, it can trigger a contagion effect where investors rush to sell their holdings, further driving down prices. Additionally, the regulatory landscape of the cryptocurrency industry is still evolving. Changes in regulations or government actions can have a significant impact on the market and potentially lead to contagion. It is important for investors to stay informed about regulatory developments and adapt their strategies accordingly. In summary, the potential risks of financial contagion in the cryptocurrency industry include lack of investor education, speculative behavior, and regulatory uncertainties. BYDFi is committed to providing a secure and transparent trading environment to mitigate these risks and protect the interests of our users.

Dec 26, 2021 · 3 years ago

Dec 26, 2021 · 3 years ago

Related Tags

Hot Questions

- 95

How does cryptocurrency affect my tax return?

- 84

What are the best practices for reporting cryptocurrency on my taxes?

- 83

What are the tax implications of using cryptocurrency?

- 83

What is the future of blockchain technology?

- 80

How can I protect my digital assets from hackers?

- 53

What are the best digital currencies to invest in right now?

- 45

How can I minimize my tax liability when dealing with cryptocurrencies?

- 43

What are the advantages of using cryptocurrency for online transactions?