What are the potential risks of financial contagion in the digital currency industry?

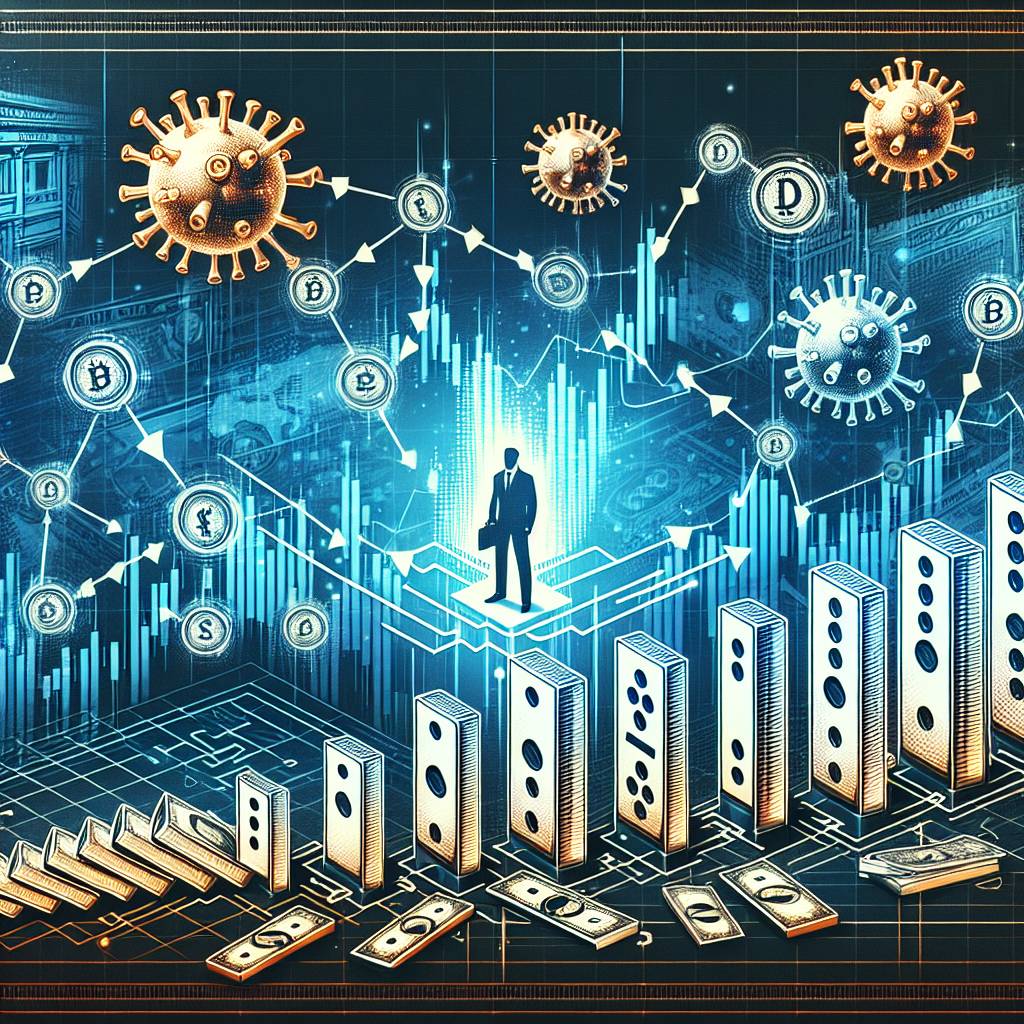

In the digital currency industry, what are the potential risks of financial contagion and how can they impact the market?

3 answers

- Financial contagion in the digital currency industry refers to the spread of financial distress or instability from one digital currency to another, leading to a domino effect and potential systemic risks. This can occur due to interconnectedness between digital currencies, where a crisis in one currency can quickly spread to others. The risks of financial contagion include increased market volatility, liquidity problems, and the potential for widespread panic among investors. It can also lead to a loss of trust in the digital currency industry as a whole, which can have long-lasting effects on market stability and investor confidence.

Mar 23, 2022 · 3 years ago

Mar 23, 2022 · 3 years ago - The potential risks of financial contagion in the digital currency industry are similar to those in traditional financial markets, but with some unique characteristics. One risk is the lack of regulation and oversight, which can make it easier for contagion to spread unchecked. Another risk is the high degree of interconnectedness between digital currencies and traditional financial institutions, which can amplify the impact of contagion. Additionally, the rapid pace of technological advancements in the digital currency industry can create vulnerabilities that can be exploited by malicious actors, further increasing the risk of contagion. Overall, the potential risks of financial contagion in the digital currency industry highlight the need for robust risk management practices and regulatory frameworks to ensure market stability and protect investors.

Mar 23, 2022 · 3 years ago

Mar 23, 2022 · 3 years ago - As a leading digital currency exchange, BYDFi recognizes the potential risks of financial contagion in the industry. We have implemented stringent risk management protocols to mitigate these risks and ensure the safety of our users' funds. Our platform utilizes advanced security measures, including multi-factor authentication and cold storage for digital assets. We also closely monitor market trends and collaborate with regulatory authorities to stay ahead of potential risks. By maintaining a strong focus on security and compliance, BYDFi aims to provide a safe and reliable trading environment for our users.

Mar 23, 2022 · 3 years ago

Mar 23, 2022 · 3 years ago

Related Tags

Hot Questions

- 69

What are the best digital currencies to invest in right now?

- 56

Are there any special tax rules for crypto investors?

- 55

What are the tax implications of using cryptocurrency?

- 51

How can I minimize my tax liability when dealing with cryptocurrencies?

- 50

What are the advantages of using cryptocurrency for online transactions?

- 45

How does cryptocurrency affect my tax return?

- 38

What are the best practices for reporting cryptocurrency on my taxes?

- 38

How can I buy Bitcoin with a credit card?