What is the difference between a cryptocurrency wallet and a traditional bank account?

Can you explain the key differences between a cryptocurrency wallet and a traditional bank account? How do they function differently and what are the advantages and disadvantages of each?

4 answers

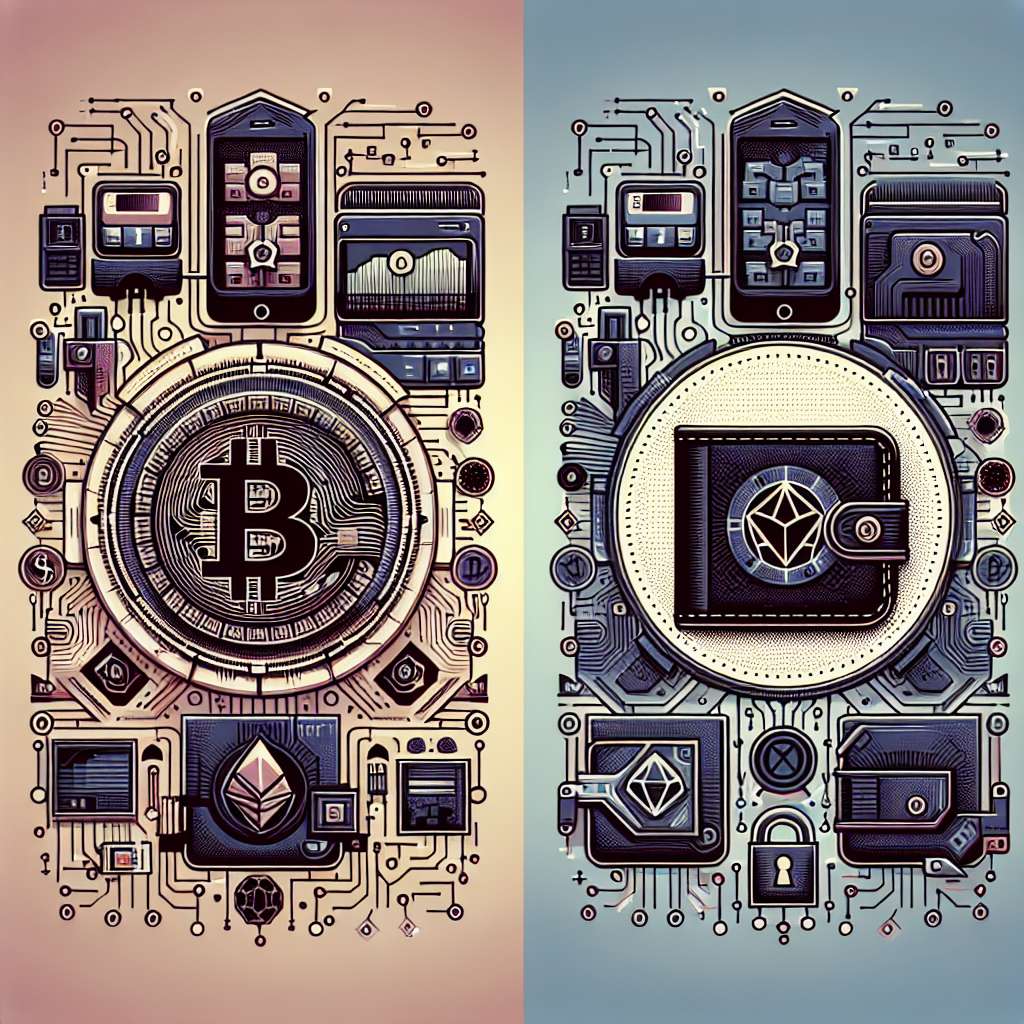

- A cryptocurrency wallet is a digital wallet that allows you to securely store, send, and receive cryptocurrencies. It is like a virtual bank account specifically designed for cryptocurrencies. Unlike traditional bank accounts, cryptocurrency wallets are decentralized and do not require a third party, such as a bank, to manage your funds. This means that you have full control over your cryptocurrencies and can access them anytime, anywhere, as long as you have an internet connection. However, this also means that you are solely responsible for the security of your wallet and if you lose access to it, you may lose your cryptocurrencies.

Dec 29, 2021 · 3 years ago

Dec 29, 2021 · 3 years ago - In contrast, a traditional bank account is a centralized financial institution that holds your money and provides various services, such as depositing, withdrawing, and transferring funds. Unlike cryptocurrency wallets, traditional bank accounts are regulated by government authorities and offer additional features, such as insurance on deposits and fraud protection. However, traditional bank accounts may have limitations on the amount of money you can withdraw or transfer, and they may charge fees for certain transactions. Additionally, traditional bank accounts are subject to the control and regulations of the banking system, which may restrict your financial freedom.

Dec 29, 2021 · 3 years ago

Dec 29, 2021 · 3 years ago - At BYDFi, we believe that cryptocurrency wallets offer several advantages over traditional bank accounts. Firstly, cryptocurrency wallets provide greater privacy and anonymity, as transactions made with cryptocurrencies are pseudonymous and do not require revealing personal information. Secondly, cryptocurrency wallets offer faster and cheaper cross-border transactions compared to traditional bank transfers, which can be slow and expensive. Lastly, cryptocurrency wallets give you the opportunity to participate in the decentralized finance (DeFi) ecosystem, where you can earn passive income through various lending and staking protocols. However, it's important to note that cryptocurrency wallets also come with certain risks, such as the potential for hacking and scams, so it's crucial to take necessary security measures to protect your funds.

Dec 29, 2021 · 3 years ago

Dec 29, 2021 · 3 years ago - Cryptocurrency wallets and traditional bank accounts serve different purposes and cater to different needs. While cryptocurrency wallets offer greater control, privacy, and potential for financial growth, traditional bank accounts provide the stability, regulation, and convenience of a centralized financial system. Ultimately, the choice between a cryptocurrency wallet and a traditional bank account depends on your individual preferences, risk tolerance, and financial goals.

Dec 29, 2021 · 3 years ago

Dec 29, 2021 · 3 years ago

Related Tags

Hot Questions

- 84

What are the best digital currencies to invest in right now?

- 73

What are the best practices for reporting cryptocurrency on my taxes?

- 68

How can I protect my digital assets from hackers?

- 54

What are the advantages of using cryptocurrency for online transactions?

- 51

How does cryptocurrency affect my tax return?

- 42

What is the future of blockchain technology?

- 36

What are the tax implications of using cryptocurrency?

- 34

How can I minimize my tax liability when dealing with cryptocurrencies?