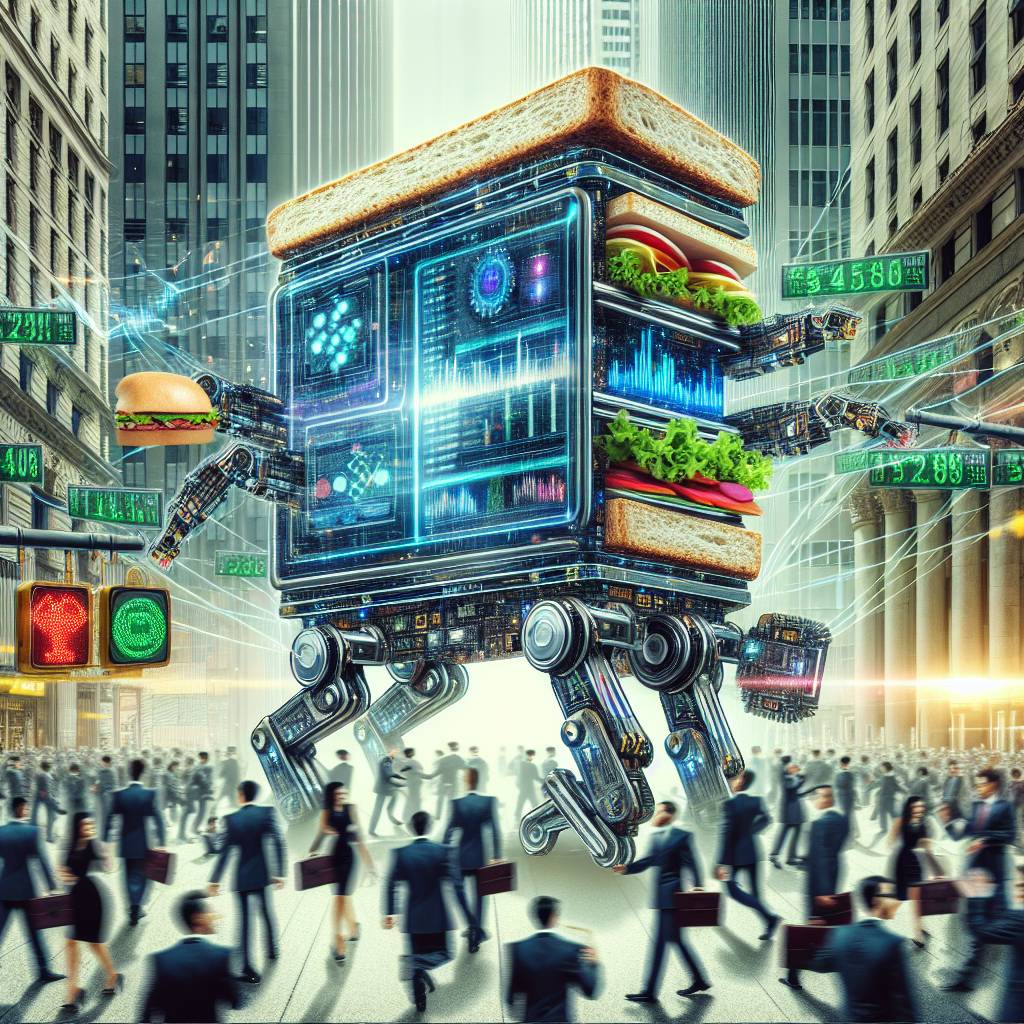

What strategies can be implemented with a sandwich bot to maximize profits in the crypto market?

What are some effective strategies that can be implemented with a sandwich bot to maximize profits in the cryptocurrency market? How can a sandwich bot be used to take advantage of price fluctuations and execute profitable trades? Are there any specific settings or parameters that need to be considered when using a sandwich bot for crypto trading?

5 answers

- One strategy that can be implemented with a sandwich bot to maximize profits in the crypto market is to take advantage of price spreads. By placing buy and sell orders on both sides of the current market price, the sandwich bot can profit from the price difference between the two orders. This strategy requires careful monitoring of market conditions and quick execution of trades to capture the price fluctuations. Additionally, setting appropriate price ranges and order sizes can help optimize the profitability of the sandwich bot.

Dec 27, 2021 · 3 years ago

Dec 27, 2021 · 3 years ago - Another strategy is to use the sandwich bot to execute arbitrage trades between different cryptocurrency exchanges. By simultaneously buying a cryptocurrency at a lower price on one exchange and selling it at a higher price on another exchange, the sandwich bot can profit from the price difference. This strategy requires integration with multiple exchanges and real-time monitoring of price differentials. It is important to note that arbitrage opportunities may be limited and may require fast execution to capture the price discrepancies.

Dec 27, 2021 · 3 years ago

Dec 27, 2021 · 3 years ago - BYDFi, a leading cryptocurrency exchange, offers a sandwich bot feature that can be used to maximize profits in the crypto market. The sandwich bot is equipped with advanced algorithms and trading strategies to identify and exploit profitable trading opportunities. It allows users to set custom parameters and trading rules to suit their individual trading preferences. With BYDFi's sandwich bot, traders can automate their trading strategies and potentially increase their profits in the volatile cryptocurrency market.

Dec 27, 2021 · 3 years ago

Dec 27, 2021 · 3 years ago - Using a sandwich bot in the crypto market can be a profitable strategy, but it is important to consider the risks involved. Market volatility, liquidity issues, and technical glitches can impact the performance of the sandwich bot. It is recommended to thoroughly test the bot in a simulated environment before deploying it with real funds. Additionally, staying updated with the latest market trends and news can help identify potential trading opportunities and make informed decisions when using a sandwich bot.

Dec 27, 2021 · 3 years ago

Dec 27, 2021 · 3 years ago - When using a sandwich bot, it is crucial to have a clear understanding of the bot's functionality and limitations. Proper risk management and diversification of trading strategies are essential to minimize potential losses. It is also advisable to regularly monitor the bot's performance and make necessary adjustments to optimize its profitability. Remember, while a sandwich bot can automate trading processes and potentially maximize profits, it should not be solely relied upon as the sole strategy for crypto trading. It is always recommended to combine bot-assisted trading with manual analysis and decision-making for the best results.

Dec 27, 2021 · 3 years ago

Dec 27, 2021 · 3 years ago

Related Tags

Hot Questions

- 81

How can I buy Bitcoin with a credit card?

- 70

What are the advantages of using cryptocurrency for online transactions?

- 49

What are the best digital currencies to invest in right now?

- 43

How does cryptocurrency affect my tax return?

- 41

What is the future of blockchain technology?

- 34

What are the tax implications of using cryptocurrency?

- 9

How can I minimize my tax liability when dealing with cryptocurrencies?

- 7

Are there any special tax rules for crypto investors?